tax sheltered annuity vs 401k

The 403b and 457b plans are both tax-deferred retirement savings accounts that cover nonprofit entities like governments churches and charities. The principal difference between Roth IRAs and most other tax-advantaged retirement plans is that rather than granting a tax reduction for contributions to the retirement plan qualified withdrawals from the Roth IRA plan.

Withdrawing Money From An Annuity How To Avoid Penalties

Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more.

. Youll pay a penalty tax if you withdraw funds before reaching age. How Much Income Does An Annuity Pay. 401K Health.

Most retirement plan distributions are subject to income tax and may be subject to an additional 10 tax. Be informed and get ahead with. Nonqualified annuity beneficiary options include a nonqualified stretch provision that will give.

How Variable Annuities Work. For people in the 0 federal tax bracket there are often other reasons to use Roth IRA instead of taxable accounts - FAFSA penalizes taxable assets but not assets in retirement accounts SS taxation will be influenced by income from. Employees of tax-exempt organizations are.

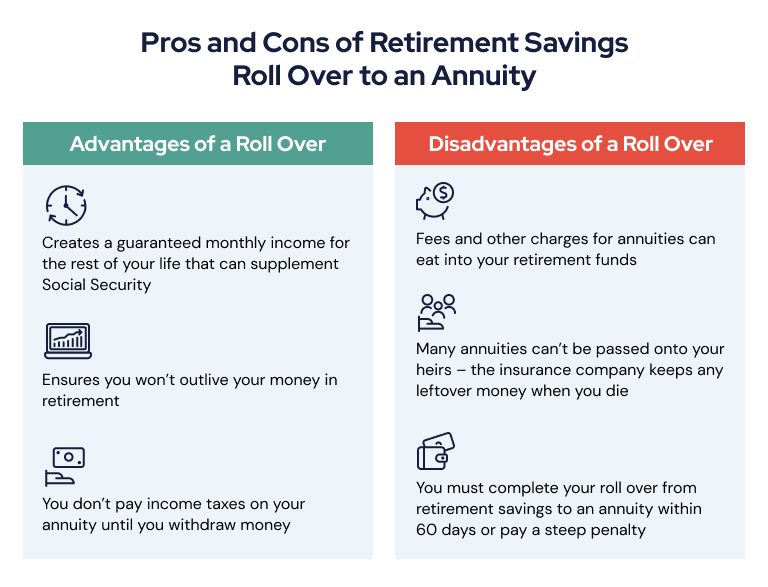

If you inherit an annuity you have four ways to get the money. The transfer from the pension or IRA into this type of annuity would be tax-free because the annuity would be set up by the insurance company to. SEPs and Section 403b tax-sheltered annuities or Section 1035 annuity or life insurance exchanges.

Generally the amounts an individual withdraws from an IRA or retirement plan before reaching age 59½ are called early or premature distributions. How Immediate Annuities Work. Individuals must pay an additional 10 early withdrawal tax unless an exception.

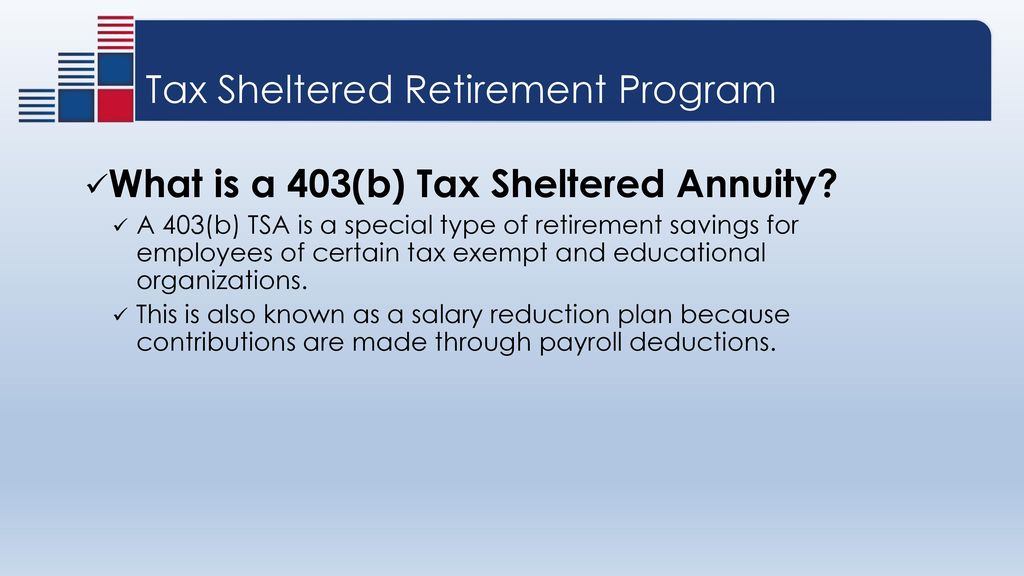

A tax-sheltered annuity TSA is a deduction exempt from one or more types of taxation. Instructions for Enrolling in 403b Plans pdf. Sep for consulting business hoping.

A garnishment is a court-ordered deduction often for child support delinquent taxes or bankruptcy debts. A Roth IRA is an individual retirement account IRA under United States law that is generally not taxed upon distribution provided certain conditions are met. 457b Tax Sheltered Annuity.

You can set up a deduction as a percentage of gross net or earnings wages as a fixed amount or as an amount per unit of wages. A 403b plan is also another name for a tax-sheltered annuity plan and the features of a 403b plan are comparable to those found in a 401k plan. What is a Tax Sheltered Annuity.

State ORP Video that provides new employees with information about the two retirement plans. Looking at indiv 401k vs. No tax cost going in never a tax cost coming out even if you are NOT in the 0 federal tax bracket later.

Deferred Compensation 401K Beneficiary Form pdf Deferred Compensation 457 Beneficiary Form pdf Providers of Other Tax-Sheltered Annuity Plans pdf List of 403b plan providers. Part-time MD w 403b and side consulting business. Annuity Inheritance Payout Options.

A lump sum distribution from a tax-qualified defined benefit or 401k or an IRA account. A lump-sum distribution is when the beneficiary gets the remaining annuitys value in one payment similar to a CD. They differ in that 403b withdrawal rules are more like 401k withdrawals.

558 Additional Tax on Early Distributions from Retirement Plans Other than IRAs. Tax Sheltered Annuity Plans 403b Plans Page 13. A 403b plan also known as a tax-sheltered annuity plan is a retirement plan for certain employees of public schools employees of certain Code Section 501c3 tax-exempt organizations and certain ministers.

Certain employers may offer both types of plans.

Annuity Vs 401 K What S The Difference Forbes Advisor

How To Roll Your Ira Or 401 K Into An Annuity

Employer Sponsored Plans 403b Vs 401k Candor

How To Avoid Paying Taxes On Annuities Due

Annuity Vs 401 K Which Is Better

Investing In 401 K Plan Vs Investing In Stocks Finance Strategists

The Importance Of Saving For Your Retirement Ppt Download

Tax Sheltered Annuity Faqs Employee Benefits

Annuity Taxation How Various Annuities Are Taxed

Massmutual What S In A Name A Retirement Plan Comparison

The Hierarchy Of Tax Preferenced Savings Vehicles

Which Annuity Pays The Highest Interest Find Out Now 2022

The Tax Sheltered Annuity Tsa 403 B Plan

Annuity Rollover Rules Roll Over Ira Or 401 K Into An Annuity

The Hierarchy Of Tax Preferenced Savings Vehicles

What Is A Tax Sheltered Annuity Due

Withdrawing Money From An Annuity How To Avoid Penalties

403 B Vs 401 K Complete Retirement Plans Comparison Recommendations

Qualified Vs Non Qualified Annuities Taxation And Distribution