option to tax unit

HMRCs Option to Tax Unit. We recently shared that we had been advised by HMRCs OTT unit that they were working to a target of 120 working days to process OTT notifications.

Option To Tax Explained Martin Aitken Co Chartered Accountants

This is a six week trial being run by HMRC Option to Tax Unit that seems likely to affect how everyone handles commercial property transactions going forwards.

. On a related matter it appears that HMRC are trialling a change to their Option To Tax acknowledgment process. Option to tax national unit cotton house 7 cochrane street glasgow g1 1gy phone 0141 285 4174 4175 fax 0141 285 4423 4454 unless you are registering for vat and also. HMRC will acknowledge all elections in writing and this is important because it gives the opter proof to provide to either their purchaser or tenants that an election.

I noticed today that the Option to Tax Unit have altered their voice message and are no longer accepting external phone calls. Employees portion of Social Security Tax for 2021 is 62. We have received reports from members of continuing delays by the Option to Tax National Unit in responding to options that have been notified.

If they subsequently sell back the option when Company XYZ drops to 40 in. 40 of the gain or loss is taxed at the short-term capital tax. Although the option to tax was introduced in 1989 the Option to Tax Unit was only formed in 2003.

HMRCs Option to Tax Unit. HMRC will acknowledge all elections in writing and this is important because it gives the opter proof to provide to either their purchaser or tenants that. 60 of the gain or loss is taxed at the long-term capital tax rates.

An option to tax is considered to be the clearest evidence that the taxpayer intends his supplies to be taxable though it should be remembered that an option to tax is disapplied in respect of. Following this we were. HMRC have no central record of options notified before then.

So in order to claim input tax on the cost of buying and improving the property our landlord must opt to tax it and be VAT-registered so that his rental income is standard-rated. Self-Employment Tax contains Social Security Tax and Medicare Tax. HMRCs VAT Notice 742A covers Option to Tax and we discuss this in further detail below.

The maximum wages and earnings subject to. Option To Tax trial period. In both circumstances you can specifically exclude new buildings from the effect of an.

Taylor purchases an October 2020 put option on Company XYZ with a 50 strike in May 2020 for 3. In Gerald Edelmans recent edition of The Property Round we. Section 1256 options are always taxed as follows.

14 June 2022. Bearing in mind that their last. The date the extended time limit for notifying an option to tax land and buildings applies to has been extended to decisions made between 15 February 2020 and 31 March.

With examples of it taking. Option to Tax. Option to Tax National Unit Cotton House 7 Cochrane Street Glasgow G1 1GY Phone 0141 285 4174 4175 Fax 0141 285 4423 4454 Unless you are registering for VAT and.

Stock Based Compensation Back To Basics

Comptroller Brad Lander On Twitter The 421 A Program Is An Obscene Tax Giveaway For Market Rate Housing In The Name Of Affordability And Slightly Altering Its Numbers And Letters Won T Change That

Detailed Thread On Sovereign Gold Bond Amp The Taxation Dilemma Twitter Thread From Chinnu Chinnunpsm Rattibha

Fillable Online Peake K12 Oh State Of Ohio Department Of Taxation Sales And Use Tax Unit Exemption Certificate The Purchaser Hereby Claims Exception Or Exemption On The Purchase Of Tangible Personal Property

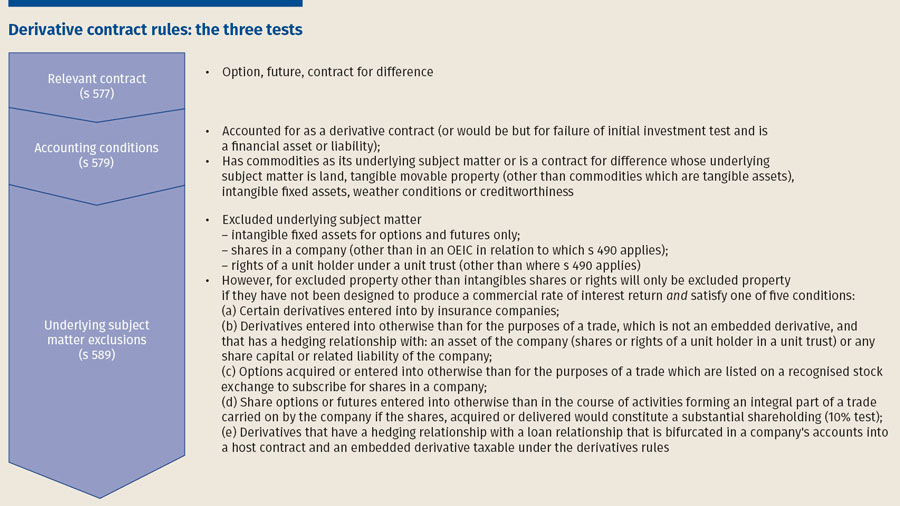

Derivatives And Complex Financial Instruments An Introduction

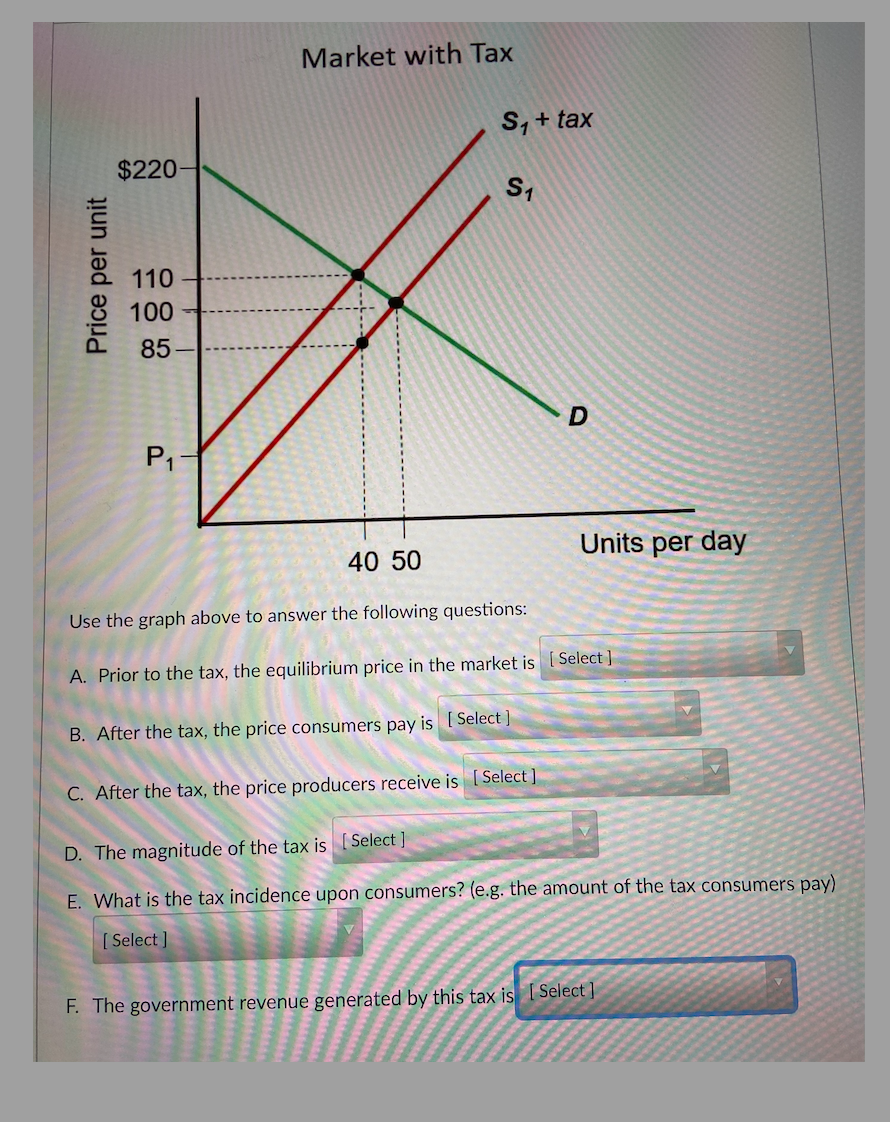

4 7 Taxes And Subsidies Principles Of Microeconomics

Solved Option A 100 85 110 10 220 Option B 110 Chegg Com

Ulip Buy Unit Linked Insurance Plans Online In 2022 Icici Prulife

Option To Tax Land And Buildings Critchleys

Enable And Create Tax Unit Excise For Dealer

Oracle E Business Tax Purchasing Whitepaper

Brazos County Commission Approves Exercising Property Tax Revenue Exemption On A 4 1 Vote Wtaw 1620am 94 5fm

Pigouvian Tax An Overview Sciencedirect Topics

Service Tax In Tally Prime Last Date

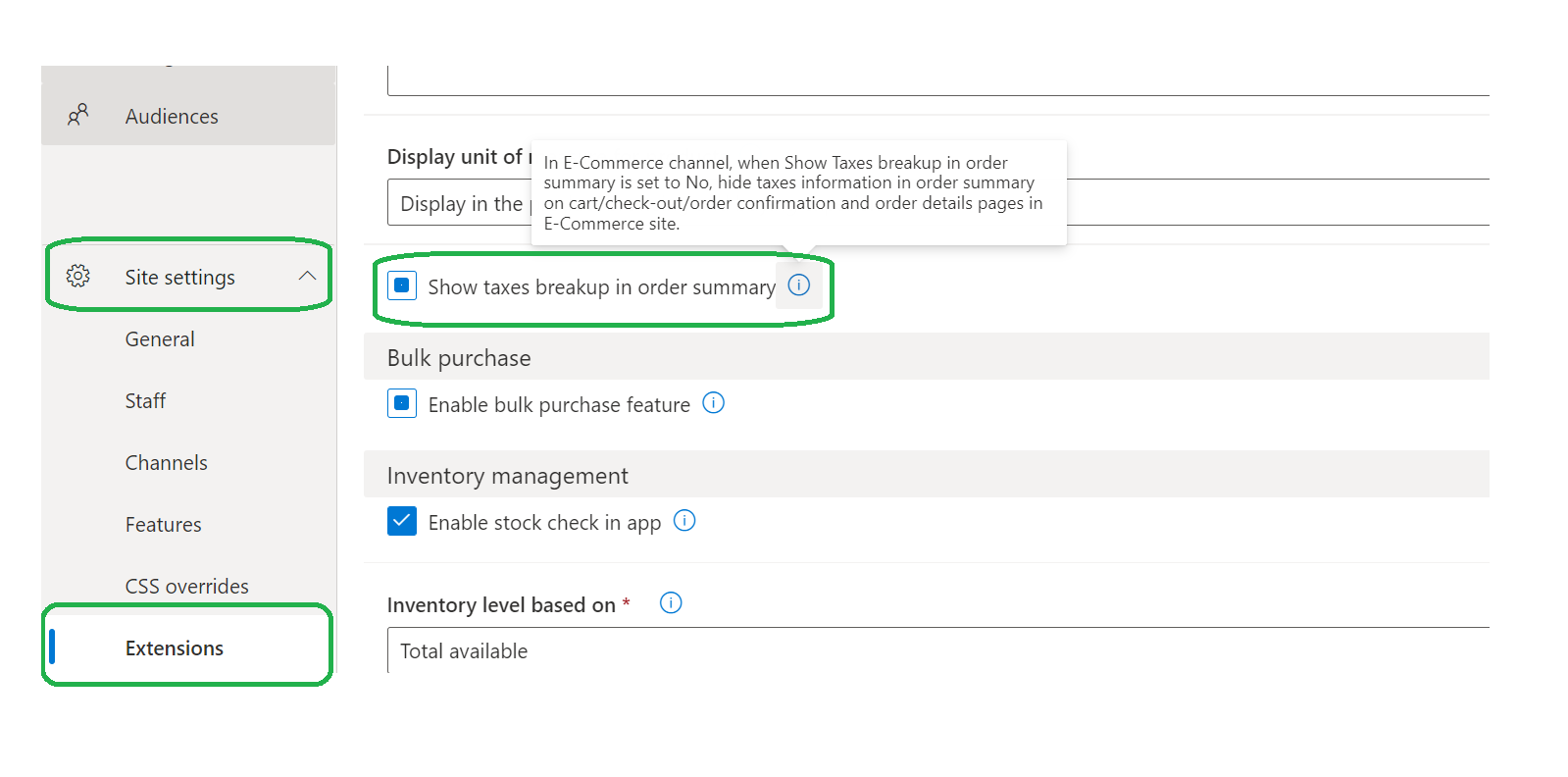

Hide Tax Breakup Information In Order Summaries Commerce Dynamics 365 Microsoft Learn

Lecture Fundamentals International Taxation Week 1 Lecture Week 1 Taxing Rights And Taxable Studeersnel